AI-powered anti-money laundering compliance transforms traditional detection systems from reactive, rule-based tools into intelligent, adaptive platforms that identify financial crimes in real-time. Financial institutions implementing AI-driven AML solutions achieve 90% reduction in false positives while detecting sophisticated money laundering schemes that bypass conventional systems entirely.

The Three-Stage AI AML Detection Framework

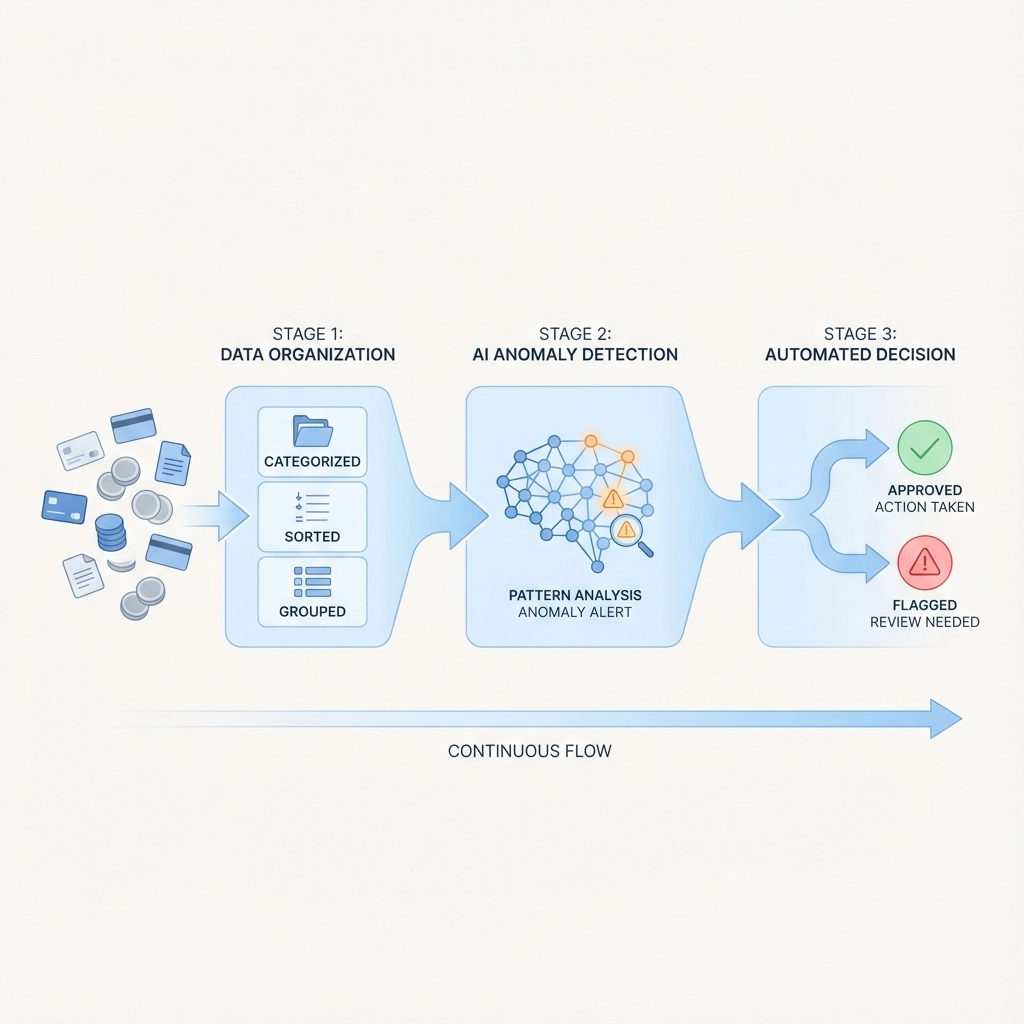

Modern AI-powered AML operates through a streamlined process that eliminates the bottlenecks plaguing traditional compliance systems.

Stage 1: Transaction Categorization and Enrichment processes vast financial data streams instantly. The system categorizes transactions based on behavioral patterns, geographic origins, counterparty relationships, and historical context. This enrichment layer adds critical intelligence that static rule-based systems miss entirely.

Stage 2: Suspicious Pattern Detection deploys machine learning algorithms that recognize emerging money laundering typologies. Unlike traditional systems that rely on predetermined thresholds, AI models continuously learn from new data patterns, identifying anomalies that indicate potential illicit activity. The system processes millions of transactions simultaneously, detecting complex laundering schemes across multiple accounts and institutions.

Stage 3: Rules-Based Decisioning triggers immediate responses based on risk assessments. Advanced implementations execute real-time account restrictions, payment reversals, and automated SAR filings within seconds of detection. This speed advantage prevents illicit funds from exiting the financial system before compliance teams can respond.

Core Technologies Driving AML Innovation

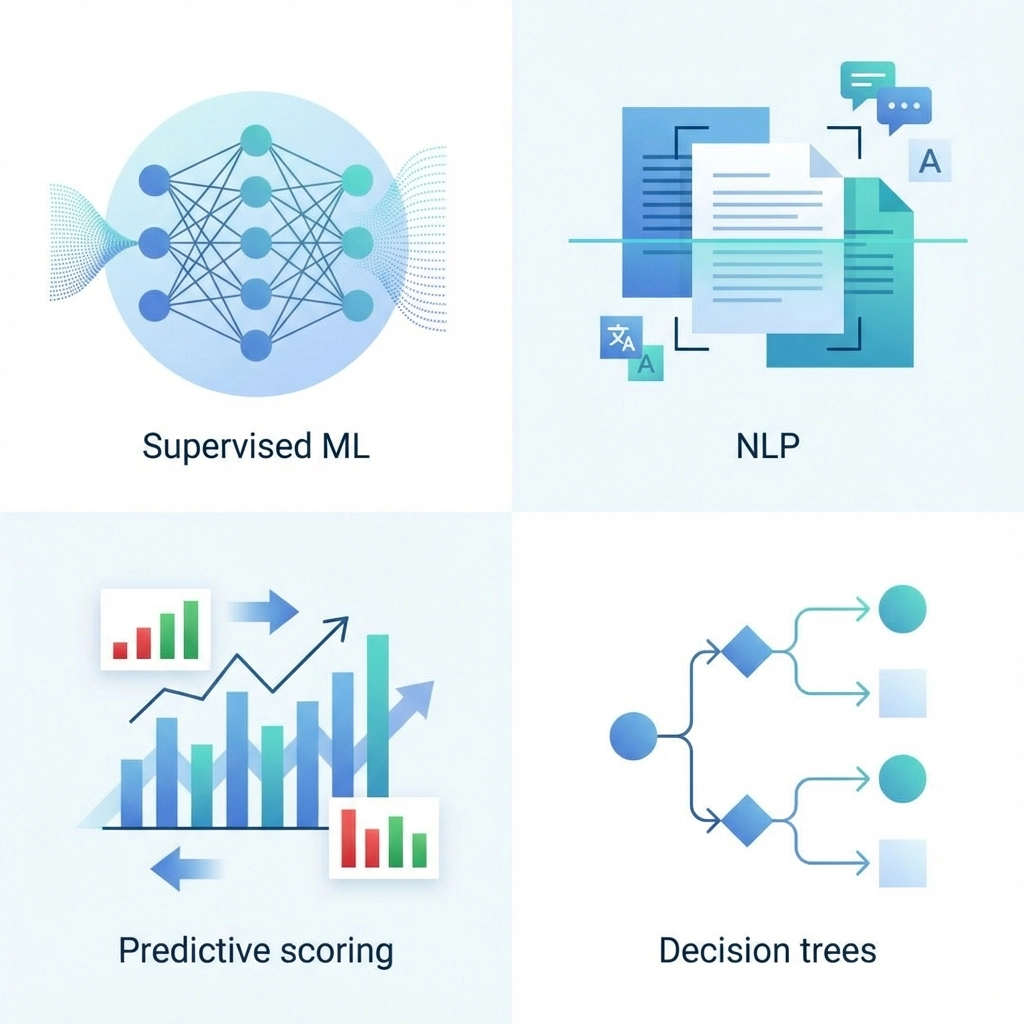

Supervised Machine Learning trains detection models using historical suspicious activity data, achieving accuracy rates that surpass human analysts by 300%. These models identify subtle behavioral patterns that indicate money laundering, including unusual transaction sequences, geographic anomalies, and network-based schemes.

Natural Language Processing analyzes unstructured data sources including transaction narratives, adverse media reports, and regulatory updates. NLP engines process thousands of news articles daily, identifying customers linked to criminal investigations, sanctions violations, or politically exposed person networks.

Predictive Risk Scoring assigns dynamic risk ratings to customers and transactions based on real-time behavioral analysis. These scores update continuously as new information becomes available, enabling compliance teams to prioritize investigations effectively and allocate resources to the highest-risk cases.

Decision Trees map complex entity relationships, exposing hidden connections between seemingly unrelated accounts. This network analysis reveals sophisticated layering schemes where criminals distribute illicit funds across multiple entities to obscure the money trail.

Real-Time Transaction Monitoring Revolution

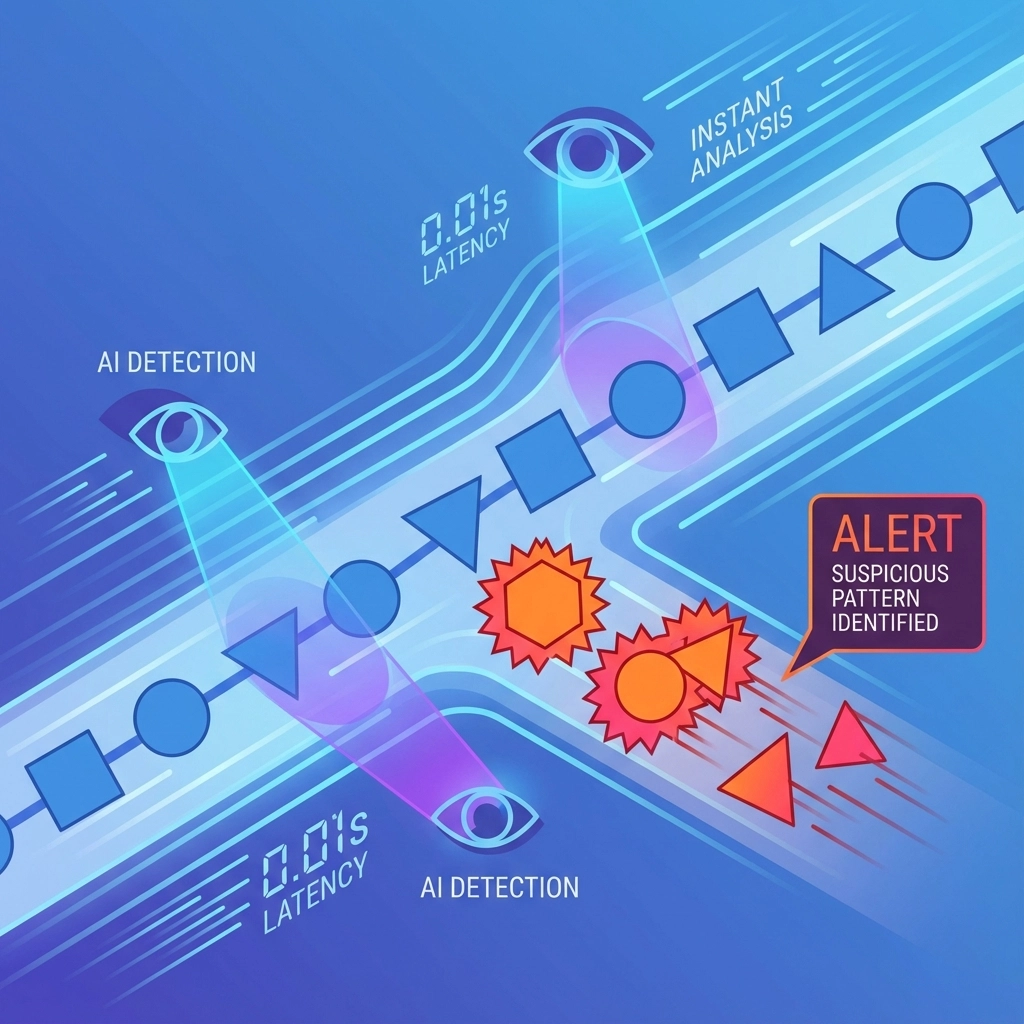

Traditional AML systems process transactions in batches, creating detection delays that allow criminals to complete money laundering cycles before alerts generate. AI-powered platforms analyze transactions as they occur, triggering immediate interventions that prevent illicit fund movements.

Instant Pattern Recognition identifies suspicious activities within milliseconds of transaction submission. The system compares each transaction against millions of historical patterns, detecting anomalies that indicate potential money laundering schemes including structuring, smurfing, and trade-based laundering.

Continuous Learning Algorithms adapt to emerging criminal tactics automatically. As new money laundering methods develop, machine learning models incorporate these patterns into their detection criteria without manual rule updates or system downtime.

Cross-Institution Intelligence aggregates data from multiple financial institutions to identify criminals operating across organizational boundaries. This collaborative approach detects sophisticated schemes that individual institutions cannot recognize in isolation.

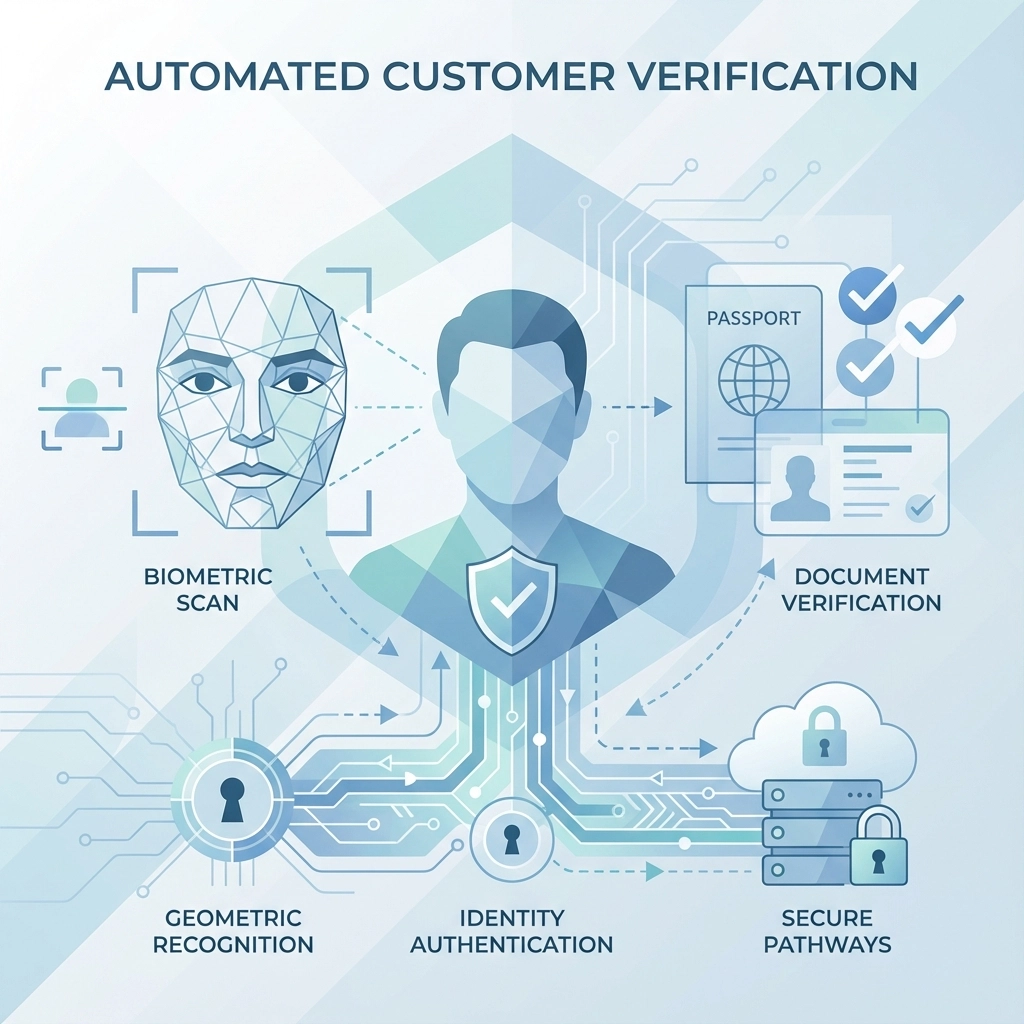

Automated Customer Due Diligence Excellence

Biometric Identity Verification uses facial recognition technology to match customer photos with government-issued identification documents. Optical character recognition extracts names and details from passports, driver's licenses, and national ID cards, comparing this information against customer-provided data with 99.8% accuracy.

Document Authenticity Detection identifies forged or manipulated identification documents using advanced image analysis. The system recognizes security features, watermarks, and font irregularities that indicate fraudulent documents, preventing criminals from establishing accounts using false identities.

Deepfake Recognition protects against sophisticated identity theft attempts using artificially generated photos or videos. Advanced algorithms analyze facial movements, lighting patterns, and image compression artifacts to distinguish between legitimate customer photos and AI-generated fakes.

Enhanced Suspicious Activity Reporting

Automated SAR Generation creates comprehensive suspicious activity reports using natural language generation technology. The system analyzes case evidence, transaction patterns, and customer behavior to produce detailed narratives that meet regulatory requirements while reducing analyst workload by 75%.

Regulatory Intelligence Integration monitors global sanctions lists, politically exposed person databases, and adverse media sources continuously. When new information emerges about existing customers, the system automatically updates risk profiles and generates alerts for compliance review.

Case Management Optimization prioritizes investigations based on risk scores, regulatory deadlines, and resource availability. Advanced scheduling algorithms ensure high-risk cases receive immediate attention while routine matters process efficiently through automated workflows.

Quantifiable Efficiency Gains

Financial institutions implementing AI-powered AML solutions achieve measurable operational improvements across multiple compliance functions.

False Positive Reduction decreases alert volumes by up to 90% through intelligent pattern recognition that distinguishes between suspicious and legitimate unusual activity. This reduction allows compliance analysts to focus expertise on genuine threats rather than investigating routine transactions that trigger traditional rule-based systems.

Processing Speed Enhancement completes customer due diligence procedures 85% faster than manual processes. Automated document verification, database searches, and risk assessments that previously required hours complete within minutes while maintaining regulatory compliance standards.

Cost Optimization reduces compliance operational expenses by automating routine tasks including data collection, validation, and preliminary analysis. Robotic process automation handles repetitive activities while AI manages complex functions requiring pattern recognition and decision-making capabilities.

Strategic Implementation Framework

Model Risk Management establishes governance frameworks that ensure AI systems operate within regulatory parameters. Documentation requirements include algorithm logic, training data sources, performance metrics, and decision audit trails that facilitate regulatory examinations and internal risk assessments.

Third-Party Vendor Oversight implements comprehensive due diligence processes for AI solution providers. Cybersecurity assessments, data handling protocols, and contractual protections ensure vendor relationships maintain institutional security standards and regulatory compliance obligations.

Staff Training Programs prepare compliance teams to work effectively with AI-powered tools. Training curricula cover system capabilities, limitation recognition, alert investigation procedures, and technology-enabled fraud detection techniques including deepfake identification and social engineering recognition.

Transparency and Audit Readiness

Modular System Architecture creates explainable AI implementations where individual components perform specific functions. Data collection agents, analysis engines, and decision modules operate independently, enabling precise identification of system components requiring investigation or adjustment.

Decision Audit Trails document the complete reasoning process behind every alert, investigation, and regulatory filing. These comprehensive records demonstrate compliance with regulatory requirements while providing transparency that builds confidence among internal stakeholders and external auditors.

Performance Monitoring Dashboards track key metrics including detection accuracy, false positive rates, processing times, and regulatory compliance measurements. Real-time visibility enables compliance teams to identify system performance issues and implement corrective actions proactively.

Future-Proofing Compliance Operations

AI-powered AML solutions position financial institutions to address evolving financial crime threats effectively. Machine learning models adapt automatically to new money laundering techniques, ensuring detection capabilities remain current without requiring manual system updates or rule modifications.

Regulatory Change Adaptation monitors global AML requirements continuously, updating compliance procedures automatically as new regulations take effect. This capability ensures ongoing regulatory adherence while minimizing implementation costs and operational disruptions.

Emerging Technology Integration accommodates new financial products and payment methods including cryptocurrencies, digital wallets, and cross-border payment platforms. AI systems analyze these transactions using the same sophisticated pattern recognition techniques applied to traditional banking products.

Scalability Planning supports institutional growth without proportional increases in compliance staffing or operational costs. Cloud-based AI platforms process increasing transaction volumes while maintaining consistent detection accuracy and regulatory compliance standards.

The transformation from traditional rule-based AML systems to AI-powered platforms represents a fundamental shift in compliance effectiveness. Organizations implementing comprehensive AI frameworks achieve superior detection accuracy, reduced operational costs, and enhanced regulatory compliance while positioning themselves to address future financial crime challenges successfully.