Empower your organization to validate prospective B2B clients before establishing a relationship, using our cutting-edge KYB screening

Use real time access to our global registered business data to verify the legitimacy of any commercial organisation and its officers. Assess financial health and commercial risk for credit decisioning. Screen entities and individuals against PEP, sanction and watchlists, and adverse media. Discover ownership and UBO with our extended group structure feature. Real-time adverse media checks keep you on top of any negative news or events.

Keep your business safe with our fast and easy-to-use KYB solution.

Features that help you drill into what matters

Compliability’s KYB check is all about getting to the relevant company information, quickly. Visualise entities, owners and connections. Make sense of complex ownership structure clearly, even across jurisdictions. Easily trace the path from the company you engage with to its ultimate beneficial owner.

Business Identity

Advanced Entity Checks

We perform a comprehensive series of checks against global business registration bodies, tax authorities, utilities, credit bureaus, and more, to verify incorporation, ownership, address, and commercial risk.

Commercial Risk

Creditworthiness & Financial Health

Through our global credit bureau partners we verify financial health of a business . This includes checking credit rating scores and recommending credit limits, reviews of payment history, and bankruptcy records enabling an informed assessment of a companies suitablility to onboard.

Global Check

Sanction, Watchlists & Media

We verify your customer and its stakeholders have no involvement in money laundering, adverse media or other illicit activities, through checks against our vast network of partners, including credit bureaus, government data sources, utility authorities, and commercial and proprietary databases. Our live adverse media checks and alerts keep you posted on any negative news on a daily basis.

How we ensure robust KYB verification

Business Identity

Business Identity Verification is the process of confirming that a company is legitimate, legally registered, and accurately represented by the people acting on its behalf. It’s used by regulated businesses to prevent fraud, money laundering, and other illegal activities.

The process involves checking:

Business registration documents (like articles of incorporation, business licenses)

Tax identification numbers (like EIN in the U.S.)

Ownership and management details (who the directors and ultimate beneficial owners are)

Proof of physical address (utility bills, lease agreements)

Commercial Risk

Commercial Risk Checks are the process of matching a company to our global incorporated business financial data. Once matched, we are able to provide comprehensive financial accounts, credit ratings and limits, negative data such as court judgements or bankruptcy records.

Director & Shareholder Checks

Identity verification is the process of confirming that a director or shareholder is who they claim to be. It’s a critical step in preventing fraud, money laundering, and other financial crimes.

Document verification is the process of checking the authenticity and validity of official documents submitted by a director or shareholder to prove their identity, address, or other relevant details. It’s a critical part of identity verification and helps financial institutions and regulated businesses stay compliant with anti-money laundering (AML) laws.

Sanctions screening involves checking individuals or entities against official government or international lists of sanctioned parties. These sanctions can be imposed for various reasons, including terrorism, drug trafficking, human rights violations, or political conflicts.

Company Sanction & Watchlist Screening

Sanctions screening involves checking individuals or entities against official government or international lists of sanctioned parties. These sanctions can be imposed for various reasons, including terrorism, drug trafficking, human rights violations, or political conflicts.

Common sanctions lists include:

- OFAC SDN List (U.S. Treasury Office of Foreign Assets Control – Specially Designated Nationals)

- UN Sanctions List

- EU Consolidated Sanctions List

- UK HM Treasury Sanctions List

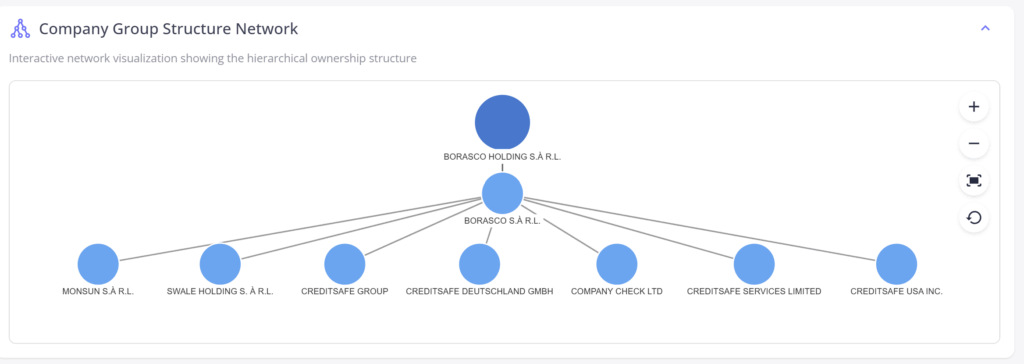

Ultimate Beneficial Owner UBO

A UBO is a natural person who ultimately:

Owns 25% or more of a company’s shares or voting rights (threshold may vary by jurisdiction).

Exercises control over the company or legal entity in other ways (e.g., through influence or control over decision-making).

Benefits from the assets or income of a trust, foundation, or similar structure.

We identify and verify an organisations legal ownership, control structure and beneficiaries, combined with PEP and watchlist screening for high risk individuals.

Source of Funds/Wealth

A Source of Wealth check investigates the origin of a UBO’s total wealth — i.e., the economic activity that generated their assets over time.

SoW checks are often mandatory when:

Dealing with Politically Exposed Persons (PEPs)

Handling high-risk jurisdictions

Large or complex transactions

Private banking or high-net-worth individuals (HNWIs)

Opening accounts for trusts or offshore structures

Adverse Media

Our adverse media screening checks a vast range of industry standard global news sources to find any negative information being posted about subject businesses or clients. With monitoring enabled, subject businesses are updated daily so that you’re always alerted to the latest events and news.

Ongoing Monitoring

Screening customers at the point of account opening or beginning of a business relationship is only the first step. As people and businesses change, being alerted to anything that could impact your risk is critically important.

- Smart Engagement Alerts

Stay ahead with real-time notifications about critical changes in your customer accounts—so you can act quickly and confidently. - Perpetual KYC & KYB Monitoring

Get instant, event-based alerts when key financial or credit information changes for individuals or businesses on your watchlist. Stay compliant, stay informed. - PEP, Sanctions & Adverse Media Screening

Re-screen customers anytime against global databases of PEPs, sanctions, and negative news. Set custom monitoring frequencies based on risk profiles—your compliance, your way. - Daily Engagement Emails

Start your day with a summary of actionable insights—timely updates that give you compelling reasons to reach out to customers and prospects.