UK high value retail faces a perfect storm: faster payments adoption has surged 34% year-over-year, while fraud losses in the retail sector hit £610 million in 2024. Luxury retailers, electronics stores, and high-end fashion brands processing transactions over £1,000 encounter unique challenges that standard fraud prevention simply cannot address.

The reality is stark. Traditional fraud detection adds 3-7 seconds to transaction processing, but customers expect instant confirmation on £5,000 purchases. Meanwhile, fraudsters exploit faster payments to drain accounts within minutes, making recovery nearly impossible once funds clear.

The UK High Value Retail Fraud Landscape

High value retail operates in a regulatory minefield. FCA regulations mandate real-time fraud monitoring for transactions exceeding £250, while PSD2 Strong Customer Authentication requirements create friction that drives 23% of legitimate customers to abandon purchases. Add faster payments into this mix, and you have a sector where split-second decisions determine whether a £8,000 luxury watch sale completes legitimately or becomes an irrecoverable loss.

The fraud patterns targeting high value retail differ fundamentally from standard e-commerce threats. Account takeover attacks specifically target customers with established purchase histories above £2,000. Synthetic identity fraud leverages stolen credentials to build credible profiles before executing single, high-value purchases. Card-not-present fraud exploits the premium customer experience expectations, where additional authentication steps feel intrusive.

Payment Services Regulations 2017 require UK retailers to implement "appropriate and proportionate" fraud prevention, but fail to define these terms for high value transactions. This regulatory ambiguity leaves retailers choosing between compliance risk and customer experience degradation.

Real-Time Behavioral Analytics: The Premium Solution

Real-time behavioral analytics represents the gold standard for high value retail fraud prevention. This approach analyzes customer interaction patterns, device fingerprinting, and transaction velocity to authenticate users without adding friction.

Implementation Benefits:

- Processes authentication in under 200 milliseconds

- Reduces false positive rates by 67% compared to rule-based systems

- Maintains seamless checkout for legitimate £3,000+ transactions

- Provides audit trails meeting FCA regulatory requirements

Regulatory Compliance Advantages:

Real-time behavioral analytics satisfies PSD2 Strong Customer Authentication through inherent factors (device characteristics) and behavioral factors (typing patterns, navigation flow). This dual-factor approach eliminates the need for disruptive SMS codes or authentication apps during premium purchases.

Cost Considerations:

Implementation requires £15,000-£25,000 initial investment for mid-size retailers, with ongoing costs of £2-4 per 1,000 transactions analyzed. ROI typically materializes within 6 months through prevented fraud losses and reduced manual review overhead.

Machine Learning Transaction Monitoring: The Adaptive Approach

Machine learning systems excel at identifying novel fraud patterns specific to high value retail. These systems adapt continuously, learning from successful attacks to prevent similar future attempts.

Core Strengths:

- Identifies previously unknown fraud patterns within 24-48 hours

- Processes unlimited transaction volume without performance degradation

- Integrates with existing payment gateways through API connections

- Provides detailed fraud probability scoring for manual review prioritization

UK Retail-Specific Applications:

Machine learning proves particularly effective for seasonal fraud patterns affecting high value retail. Black Friday fraud attempts increase 340% year-over-year, but ML systems recognize these patterns and adjust thresholds automatically. Similarly, luxury goods fraud peaks during holiday seasons, requiring adaptive detection that traditional rule-based systems cannot provide.

Regulatory Positioning:

ML transaction monitoring satisfies ICO data processing requirements through automated decision-making frameworks. However, retailers must implement human oversight for transactions exceeding £5,000 to maintain GDPR compliance regarding automated individual decision-making.

Multi-Factor Authentication Integration: The Security-First Strategy

Multi-factor authentication (MFA) provides maximum security but introduces friction that high value retail customers often resist. Success requires sophisticated implementation that maintains the premium customer experience.

Strategic Implementation:

- Step-up authentication triggers only for transactions exceeding customer's historical average by 200%

- Biometric authentication (fingerprint, facial recognition) reduces friction compared to SMS codes

- Risk-based authentication applies MFA selectively based on device trust and location factors

- WhatsApp Business API integration provides premium authentication experience

Customer Experience Optimization:

Leading high value retailers implement "trust scoring" where established customers with consistent purchase patterns bypass MFA for transactions under £2,500. New customers or unusual purchase patterns trigger graduated authentication requirements.

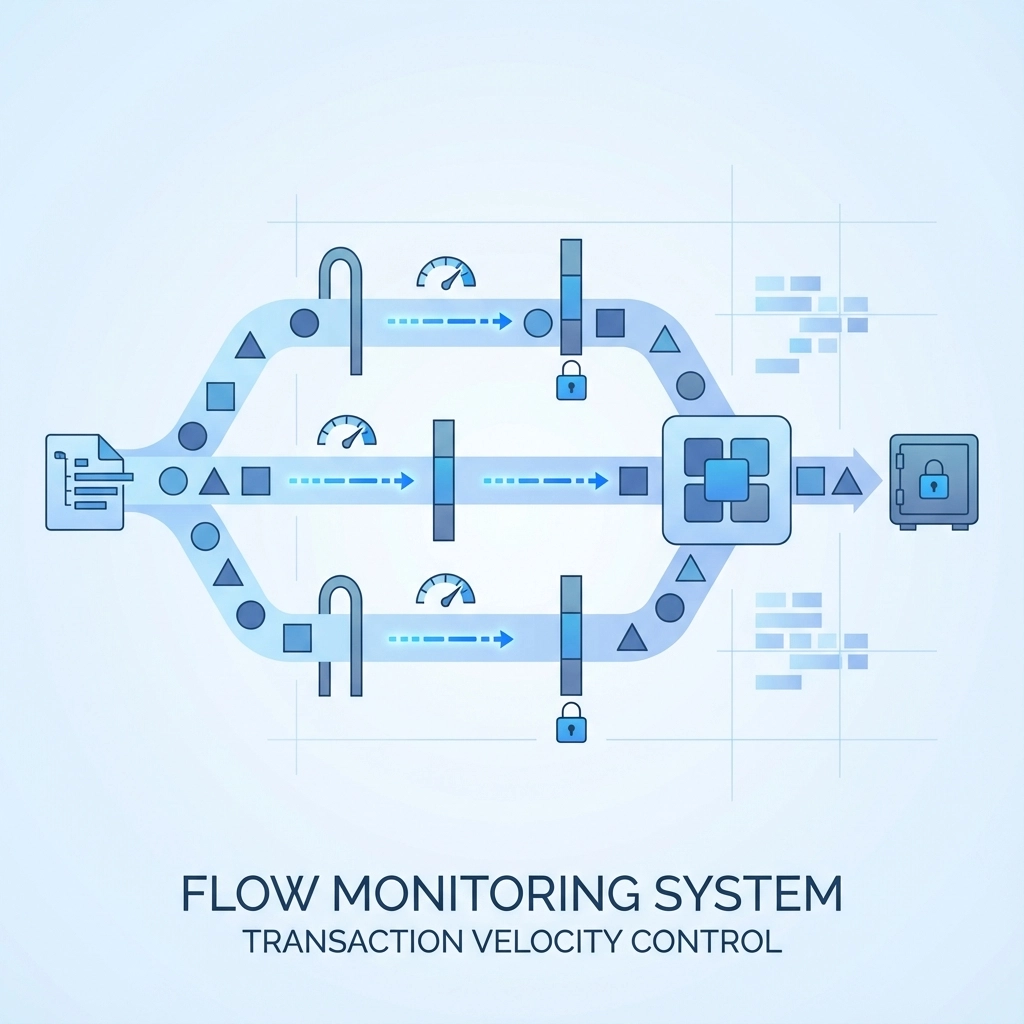

Transaction Velocity Controls: The Foundation Layer

Transaction velocity controls prevent rapid-fire fraud attempts common in high value retail account takeover scenarios. While unsexy, these controls form the foundation of comprehensive fraud prevention.

Implementation Framework:

- Customer-specific velocity limits based on 90-day purchase history

- Geographic velocity controls preventing simultaneous transactions from different locations

- Payment method velocity tracking across cards and bank accounts

- Merchant category velocity limits preventing cross-retailer exploitation

High Value Retail Optimization:

Standard velocity controls fail in luxury retail where legitimate customers regularly make multiple high-value purchases. Effective implementation requires customer segmentation based on purchase history, with VIP customers receiving elevated limits automatically.

Device Intelligence and Fingerprinting: The Silent Guardian

Device intelligence operates invisibly, collecting over 200 device characteristics to authenticate users without customer awareness. This approach proves ideal for high value retail where any visible security measures feel intrusive.

Technical Implementation:

- Browser fingerprinting captures screen resolution, installed fonts, and plugin configurations

- Mobile device intelligence tracks accelerometer patterns and touch pressure variations

- Cross-device tracking connects customer purchases across phones, tablets, and desktops

- IP reputation scoring identifies suspicious network connections

Privacy Compliance:

Device intelligence must navigate PECR (Privacy and Electronic Communications Regulations) requirements for cookie consent. Leading implementations use strictly necessary cookies for fraud prevention, avoiding consent requirements while maintaining comprehensive device tracking.

Comparative Analysis: Which Strategy Fits Your Business?

| Strategy | Implementation Cost | Monthly Operating Cost | False Positive Rate | Regulatory Compliance | Customer Friction |

|---|---|---|---|---|---|

| Real-Time Behavioral Analytics | £15,000-25,000 | £2-4 per 1,000 transactions | 0.8-1.2% | Excellent | Minimal |

| Machine Learning Monitoring | £8,000-15,000 | £1-3 per 1,000 transactions | 1.5-2.8% | Good | None |

| Multi-Factor Authentication | £5,000-12,000 | £0.50-1.50 per authentication | 0.1-0.3% | Excellent | High |

| Velocity Controls | £2,000-8,000 | £200-800 monthly | 2.1-4.5% | Good | Medium |

| Device Intelligence | £10,000-18,000 | £1-2 per 1,000 sessions | 1.8-3.2% | Moderate | None |

Strategic Recommendations by Business Profile

Luxury Retailers (£2,000+ Average Transaction Value):

Implement real-time behavioral analytics as the primary defense, supplemented by device intelligence for comprehensive coverage. This combination provides maximum protection while maintaining the frictionless experience luxury customers demand. Budget £20,000-30,000 for implementation with ongoing costs of £3-5 per 1,000 transactions.

Electronics and Technology Retailers (£500-2,000 Average Transaction Value):

Deploy machine learning transaction monitoring with velocity controls as backup. This approach balances cost-effectiveness with strong fraud prevention, suitable for retailers processing high transaction volumes with moderate per-transaction values.

Fashion and Lifestyle Retailers (£200-1,000 Average Transaction Value):

Combine device intelligence with risk-based MFA for high-value outlier transactions. This strategy provides comprehensive protection while keeping operational costs manageable for retailers with diverse transaction value ranges.

Implementation Timeline and Regulatory Considerations

Successful fraud prevention implementation requires 8-12 weeks for comprehensive deployment. Week 1-3 focuses on system integration and testing. Weeks 4-6 involve staff training and process refinement. Weeks 7-9 handle live deployment with monitoring. Weeks 10-12 optimize performance based on real-world data.

FCA compliance audits typically examine fraud prevention effectiveness 6-9 months post-implementation. Document all configuration decisions, false positive rates, and fraud detection statistics to demonstrate "appropriate and proportionate" measures during regulatory review.

UK high value retail fraud prevention succeeds through layered implementation rather than single-solution approaches. The optimal strategy combines real-time detection with selective authentication, maintaining both security and customer experience standards that define premium retail success.

Your fraud prevention strategy determines whether faster payments become a competitive advantage or an operational liability. Choose systems that grow with your business while meeting the exacting standards of UK regulatory compliance and customer expectations.