The compliance landscape for UK residential estate agents has undergone a remarkable transformation. Where traditional verification processes once required weeks of manual document review and cross-referencing, intelligent technology now delivers comprehensive compliance insights in minutes. Estate agencies across the UK are discovering how AI-powered platforms streamline Source of Funds verification, automate Proof of Ownership checks, and integrate Land Registry searches into seamless digital workflows.

This technological revolution isn't just changing how compliance works: it's fundamentally improving the client experience while delivering unprecedented accuracy and regulatory assurance.

AI-Powered Source of Funds Verification Transforms Client Onboarding

Modern Source of Funds verification leverages artificial intelligence to analyse financial patterns with remarkable precision. Advanced algorithms examine bank statements, transaction histories, and income sources simultaneously, identifying legitimate fund origins within seconds rather than days.

Machine learning systems now recognise salary payments, investment returns, property sales proceeds, and inheritance transfers automatically. These platforms cross-reference multiple data sources, building comprehensive financial profiles that provide complete transparency into fund legitimacy. The technology eliminates manual document review while increasing accuracy through pattern recognition that human analysts simply cannot match at scale.

Estate agencies report verification times dropping from 5-10 business days to under 15 minutes. VSiD's automated systems identify potential Anti-Money Laundering risks within seconds, while comprehensive platforms deliver complete Source of Funds reports that satisfy regulatory requirements instantly. This speed transformation allows agencies to progress transactions faster while maintaining rigorous compliance standards.

The integration capabilities extend beyond basic verification. Open Banking technology enables platforms to categorise fund sources automatically, distinguishing between employment income, business profits, investment gains, and other legitimate sources. This granular analysis provides the detailed documentation required for high-value property transactions while simplifying the process for both agents and clients.

Streamlined Proof of Ownership Through Digital Integration

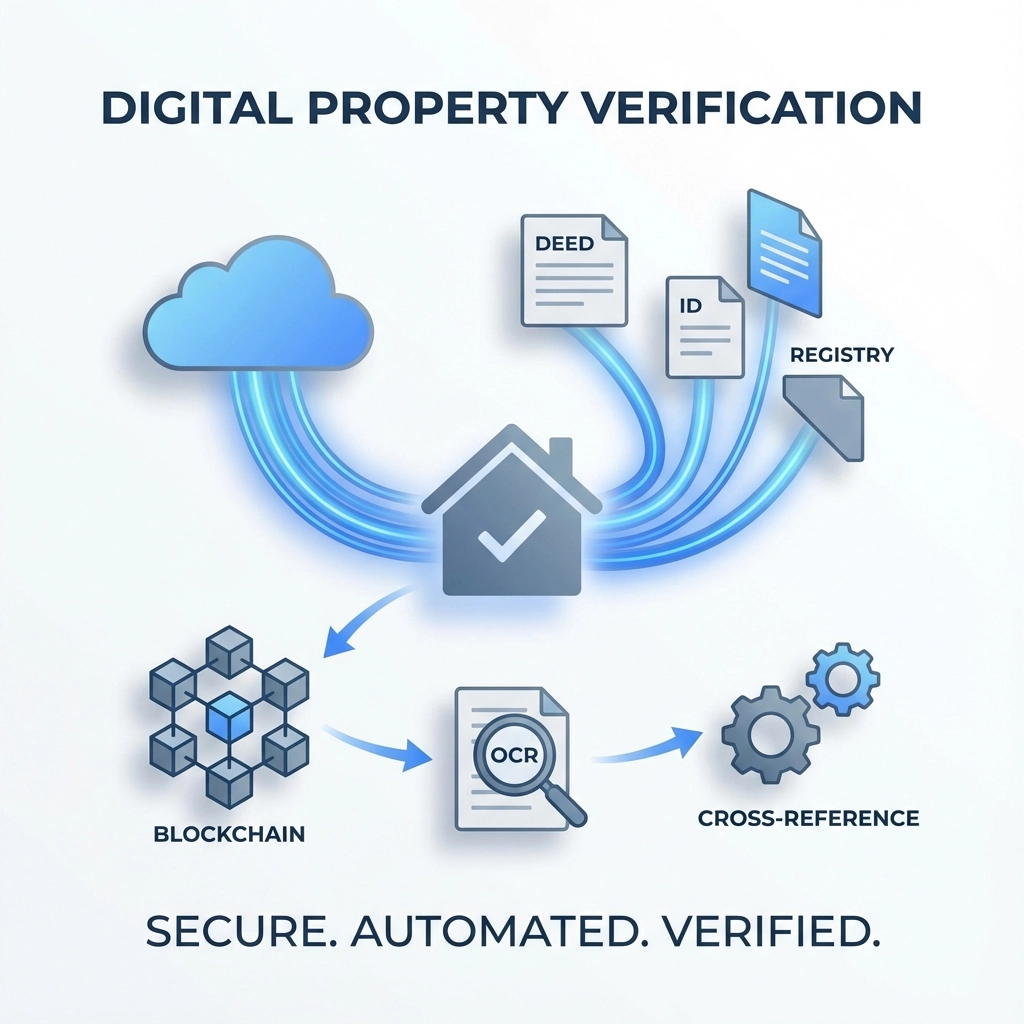

Proof of Ownership verification has evolved from manual registry searches and document collection into integrated digital workflows. Modern platforms connect directly with official registries, providing real-time ownership confirmation and historical property data in comprehensive reports.

These systems automatically verify current ownership status, identify any charges or encumbrances, and confirm the legal authority to transact. The technology eliminates the traditional back-and-forth between agencies, solicitors, and registry offices, delivering definitive ownership confirmation within minutes.

Optical Character Recognition (OCR) technology processes ownership documents automatically, extracting relevant data and cross-referencing it against official records. This automation ensures accuracy while removing the manual effort previously required for document verification. Complex ownership structures involving trusts, companies, or multiple parties are mapped automatically, providing clear visual representations of ownership chains.

The integration extends to ongoing monitoring, with systems tracking ownership changes and alerting agencies to any modifications that might affect pending transactions. This proactive approach prevents last-minute complications while ensuring all parties maintain current ownership information throughout the transaction process.

Land Registry Automation Revolution

Land Registry integration represents one of the most significant technological advances in estate agency compliance. Direct API connections with HM Land Registry enable instant property searches, title confirmations, and ownership verification through automated workflows.

Real-time Land Registry access provides comprehensive property histories, including previous sales, ownership transfers, and any registered interests or restrictions. This information integrates directly into client files, creating complete property profiles without manual search requests or waiting periods.

The automation extends to ongoing monitoring, with systems tracking Land Registry updates and alerting agencies to any changes affecting their properties or clients. This continuous oversight ensures agencies maintain current information while identifying potential issues before they impact transactions.

Advanced platforms combine Land Registry data with additional property intelligence, including planning permissions, building regulations compliance, and environmental factors. This comprehensive approach provides estate agents with complete property insights that enhance client service while ensuring regulatory compliance.

Comprehensive KYC and AML in One Platform

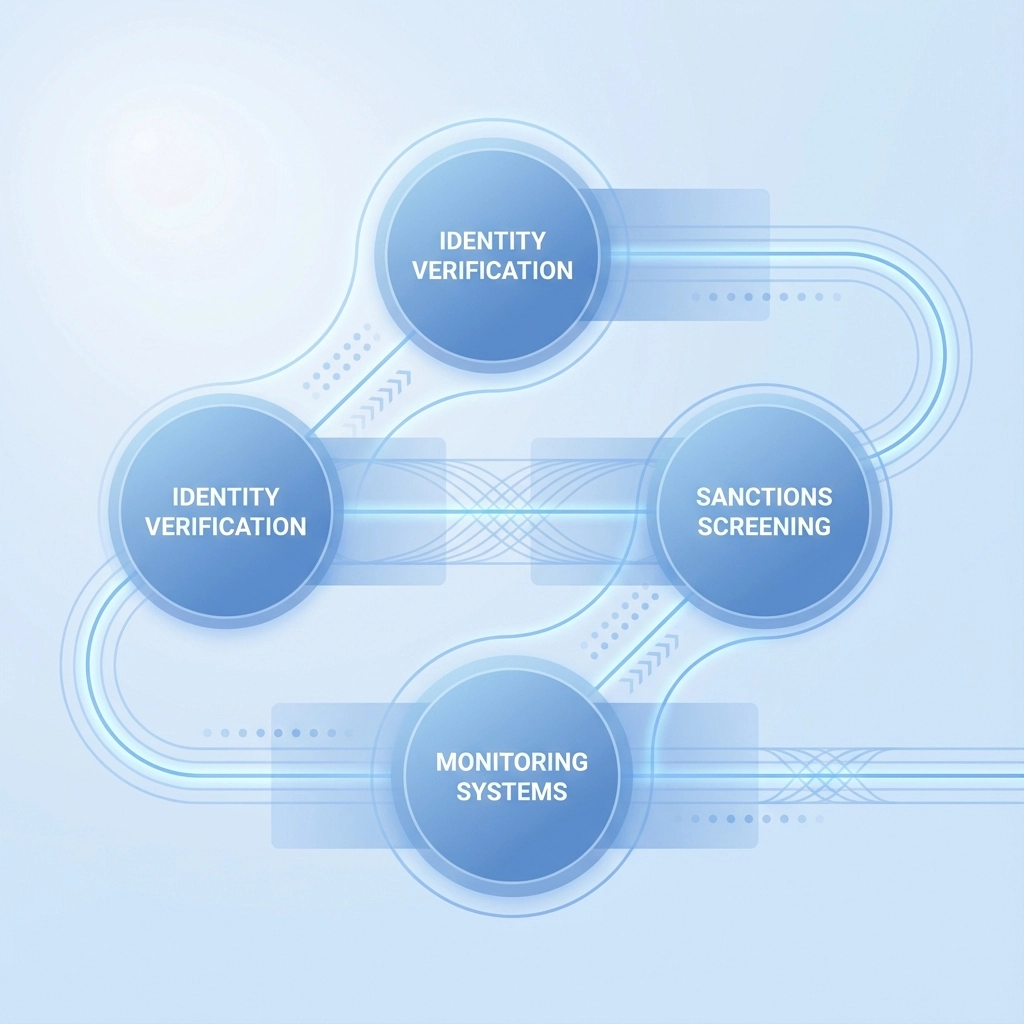

Know Your Customer and Anti-Money Laundering compliance benefits enormously from integrated technology platforms. Modern systems combine identity verification, sanctions screening, Politically Exposed Persons (PEP) checks, and adverse media monitoring into streamlined workflows.

Automated identity verification uses multiple data sources to confirm client identities instantly. Document authentication technology verifies passports, driving licenses, and utility bills, while biometric verification ensures document holders match their identification. These processes complete in minutes rather than the hours or days required for manual verification.

Sanctions screening operates continuously, monitoring global sanctions lists and updating client risk profiles automatically. The technology identifies potential matches immediately, enabling agencies to address compliance concerns proactively rather than discovering issues during later stages of transactions.

PEP screening extends beyond basic list checking to analyse family connections, business associations, and indirect relationships. This comprehensive approach ensures agencies identify all relevant political connections while maintaining efficient onboarding processes for legitimate clients.

The integration of AML monitoring provides ongoing transaction oversight, identifying unusual patterns or activities that might indicate money laundering risks. These systems learn normal client behaviour patterns, flagging deviations that warrant investigation while avoiding false positives that disrupt legitimate transactions.

Real-Time Monitoring and Risk Assessment

Continuous monitoring capabilities transform compliance from periodic checking into ongoing risk management. Modern platforms monitor client activities, transaction patterns, and external factors continuously, providing real-time risk assessments that keep agencies ahead of potential compliance issues.

Real-time sanctions monitoring updates client risk profiles instantly when new sanctions are imposed or existing ones modified. This immediate awareness prevents agencies from inadvertently conducting business with sanctioned individuals or entities, ensuring consistent regulatory compliance.

Transaction monitoring analyses payment patterns, identifying unusual activities that might indicate money laundering or other financial crimes. The technology recognises normal client behaviour patterns, flagging significant deviations while allowing legitimate but unusual transactions to proceed with appropriate documentation.

External intelligence integration provides broader risk context, monitoring news sources, regulatory announcements, and industry intelligence that might affect client risk profiles. This comprehensive approach ensures agencies maintain complete situational awareness while focusing their attention on genuine compliance concerns.

The Complete Digital Workflow

Modern compliance platforms integrate all verification processes into unified workflows that eliminate redundancies and accelerate client onboarding. These comprehensive systems handle Source of Funds verification, Proof of Ownership confirmation, Land Registry searches, and KYC/AML checks through connected processes that share data seamlessly.

Automated workflow orchestration ensures all necessary checks complete in optimal sequence, with systems handling dependencies and prerequisites automatically. Clients provide information once, with the platform distributing data to relevant verification processes and compiling comprehensive compliance reports.

Document management integration stores all verification documents securely, creating complete audit trails that satisfy regulatory requirements while enabling quick access for reviews or updates. Advanced search capabilities allow agencies to locate specific information instantly, improving efficiency during client interactions or regulatory inquiries.

The platform intelligence learns from verification patterns, optimising processes and identifying opportunities for further automation. Machine learning algorithms improve accuracy over time while reducing false positives that might delay legitimate transactions.

Compliability's comprehensive platform exemplifies this integrated approach, combining Source of Funds verification, Proof of Ownership checks, Land Registry integration, and complete KYC/AML workflows into seamless compliance management. The platform's AI-powered automation delivers industry-leading verification speeds while maintaining the rigorous standards required for UK estate agency compliance.

Future-Ready Compliance Excellence

Technology continues advancing compliance capabilities, with emerging innovations promising even greater efficiency and accuracy. Artificial intelligence becomes more sophisticated, blockchain integration provides immutable audit trails, and API connections expand to encompass broader data sources.

Estate agencies adopting comprehensive compliance technology position themselves for continued success in an increasingly regulated environment. These platforms deliver immediate benefits through faster transactions and improved client experiences while providing the scalability and adaptability required for future regulatory developments.

The transformation from manual compliance processes to intelligent automation represents more than operational improvement: it enables estate agencies to focus on client service and business growth while maintaining exemplary regulatory standards. Technology has genuinely taken the pain out of compliance, replacing complexity with clarity and delivering confidence through comprehensive automation.