Real estate compliance in 2025 isn't just another checkbox exercise: it's the difference between thriving and surviving in today's regulatory landscape. The "Right to Rent" requirements have evolved from simple identity checks into comprehensive compliance frameworks that demand precision, documentation, and automated oversight.

Property managers and landlords who treat compliance as an afterthought face escalating financial penalties, legal exposure, and operational chaos. Those who embrace systematic compliance gain competitive advantages, reduce risk exposure, and streamline their entire rental operation.

The New Reality: Compliance as Business Strategy

The regulatory environment has fundamentally shifted. What began as basic right-to-rent checks has expanded into multi-layered compliance requirements spanning tenant screening, property safety standards, rent control measures, and enhanced transparency mandates.

Financial Impact is Immediate

Non-compliance costs have skyrocketed beyond traditional penalty structures. Courts now demand meticulous documentation for evictions, from written justifications to maintenance records and complete communication logs. Missing documentation isn't inconvenient: it's legally disastrous.

Security deposit caps now limit your financial flexibility across multiple jurisdictions. Georgia restricts deposits to two months' rent maximum, while other states implement similar constraints that prevent landlords from offsetting tenant risk through higher deposits.

Operational Efficiency Through Compliance

Systematic compliance creates automated protection for your assets rather than forcing reactive crisis management. When transparency and fairness are built into operations from inception, you eliminate disputes, minimize tenant turnover, and avoid costly court battles that consume resources and time.

Modern tenants actively seek landlords who communicate clearly and operate transparently. This trust translates directly into lower turnover rates, stronger community reputations, and premium rental positioning.

Critical 2025 Regulatory Changes Transforming Real Estate

Extended Notice and Eviction Requirements

Multiple jurisdictions now mandate 90-day notice periods before lease termination or rent increases. Georgia requires seven-day written notice before eviction filing for nonpayment, plus 60-day advance notice for rent increases after lease term completion.

These extended timelines demand sophisticated planning systems and bulletproof documentation processes. Manual tracking methods fail under these requirements.

Rent Control Expansion

States with historically market-rate policies now implement strict rent caps. Washington's House Bill 1217 prohibits rent increases exceeding 7% plus inflation or 10% annually, whichever proves lower. This represents seismic shifts in previously unregulated markets.

Enhanced Transparency Mandates

2025 marks the transparency requirement turning point across multiple states. Landlords must provide itemized security deposit deduction receipts, written rent adjustment explanations, and advance notice of all fees, maintenance schedules, and property conditions.

Late fees, pet fees, cleaning charges, and non-refundable amounts require clear lease agreement documentation. Verbal agreements and unclear terms create instant legal vulnerabilities.

Habitability and Safety Standards

Georgia's "Safe at Home Act" exemplifies new minimum standards requiring landlords to maintain health and safety-compliant properties with prompt maintenance issue resolution. Tenants possess legal rights to pursue court claims for properties unfit for human habitation.

Criminal Screening Modifications

New York's Fair Chance Housing Act, effective January 1, 2025, requires conditional lease offers before criminal screening occurs. Lookback periods reduce to three years for misdemeanors and five years for felonies, with mandatory applicant disclosures.

Application Fee Restrictions

California's AB 2493 restricts landlord screening fee charges when no units are available or will be available within reasonable timeframes. These restrictions eliminate traditional revenue sources while increasing administrative complexity.

The Hidden Costs of Non-Compliance

Legal Exposure Multipliers

Each compliance failure creates cascading legal vulnerabilities. Improper eviction procedures don't just delay tenant removal: they expose landlords to wrongful eviction lawsuits, attorney fee awards, and potential damages that exceed annual rental income.

Operational Chaos

Manual compliance tracking systems collapse under 2025's complexity. Spreadsheets and paper files cannot manage multi-jurisdiction requirements, deadline tracking, and documentation standards that modern regulations demand.

Reputation and Market Position

Non-compliant landlords face public records of violations, court judgments, and regulatory sanctions that permanently damage their market position. Professional tenants research landlord compliance records before application submission.

Financial Impact Beyond Penalties

Compliance failures trigger insurance claims denials, financing complications, and sale value reductions that extend far beyond direct penalty costs. Properties with compliance histories face reduced investor interest and lower market valuations.

Systematic Compliance Strategy for 2025 Success

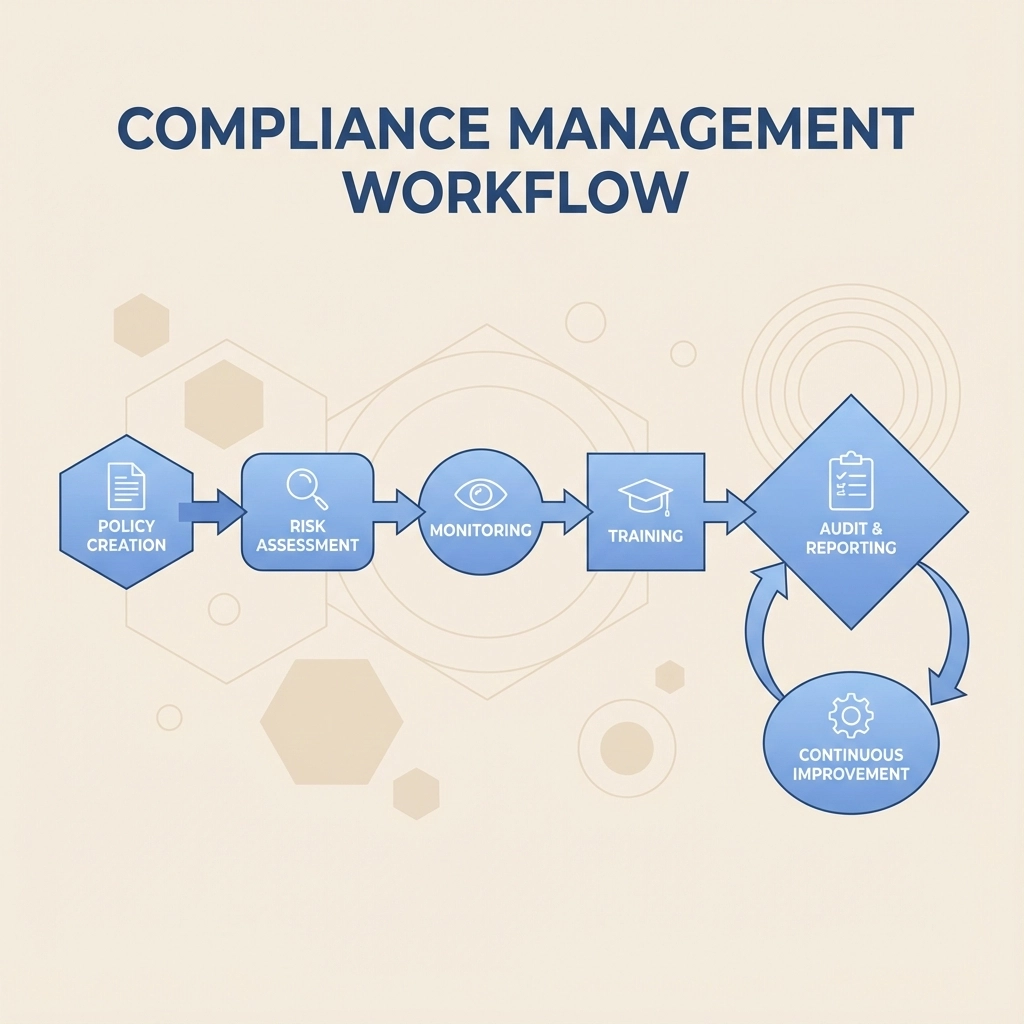

Automated Documentation Systems

Manual record-keeping fails under current regulatory demands. Successful property managers implement automated systems that capture tenant communications, maintenance requests, payment histories, and compliance deadline tracking without human intervention.

Digital documentation provides timestamped, searchable records that satisfy court requirements and regulatory audits. Paper-based systems create gaps that regulators and opposing attorneys exploit.

Proactive Regulatory Monitoring

Compliance requirements change continuously across jurisdictions. Subscribe to automated regulatory update services that deliver jurisdiction-specific changes directly to your management systems rather than relying on manual research.

Professional Integration Networks

Build relationships with compliance-focused attorneys, accountants, and property management professionals who understand 2025's regulatory landscape. Reactive legal consultation costs exponentially more than proactive compliance guidance.

Tenant Education Protocols

Clear tenant communication about policy changes, compliance requirements, and mutual obligations reduces misunderstandings and reinforces professional credibility. Educated tenants become compliance partners rather than adversaries.

Technology Solutions for Scalable Compliance

Integrated Compliance Platforms

Modern RegTech solutions provide comprehensive compliance management that spans tenant screening, documentation, deadline tracking, and regulatory updates within unified platforms. These systems eliminate manual processes that create compliance gaps.

Real-Time Monitoring Capabilities

Advanced platforms offer real-time compliance status monitoring, automated deadline alerts, and regulatory change notifications that keep property portfolios compliant without constant manual oversight.

Documentation and Audit Trails

Digital platforms create comprehensive audit trails that satisfy regulatory requirements while providing legal protection through timestamped, searchable documentation of all compliance activities.

Multi-Jurisdiction Management

Property managers operating across multiple jurisdictions need systems that automatically apply jurisdiction-specific requirements without manual rule configuration or oversight.

The Competitive Advantage of Compliance Excellence

Market Differentiation

Compliance-focused landlords differentiate themselves in competitive markets through professional operations, transparent communication, and reduced tenant friction. These advantages translate into premium positioning and reduced vacancy rates.

Operational Efficiency

Systematic compliance creates operational efficiencies that reduce administrative overhead, eliminate crisis management, and enable scalable growth without proportional compliance burden increases.

Risk Mitigation

Comprehensive compliance programs eliminate legal exposure, reduce insurance costs, and protect property values through proactive risk management rather than reactive damage control.

Implementation Timeline and Action Items

Immediate Actions (Next 30 Days)

- Audit current compliance documentation systems

- Identify jurisdiction-specific requirements for all properties

- Implement automated deadline tracking for all compliance requirements

- Review and update all lease agreements for 2025 regulatory compliance

Short-term Strategy (Next 90 Days)

- Deploy integrated compliance management technology

- Establish professional advisory relationships

- Create tenant education materials for new regulations

- Implement proactive regulatory monitoring systems

Long-term Excellence (Next 12 Months)

- Build competitive advantages through compliance excellence

- Scale operations using automated compliance systems

- Develop market reputation as compliance-focused operator

- Achieve operational efficiency through systematic processes

Real estate compliance in 2025 determines whether your property business scales successfully or struggles with constant regulatory challenges. The choice between manual compliance management and systematic, technology-enabled solutions directly impacts your operational efficiency, legal exposure, and competitive market position.

Investment in comprehensive compliance systems pays dividends through reduced legal costs, improved tenant relationships, operational efficiency gains, and sustainable business growth. The question isn't whether you can afford compliance technology: it's whether you can afford to operate without it.