False positives in gambling customer onboarding don't just cost you players: they devastate your bottom line in one of the most competitive industries on the planet. Every legitimate customer rejected during registration represents hundreds, sometimes thousands of pounds in lifetime value walking straight to your competitors.

In the UK gambling sector, where customer acquisition costs average £200-400 per player and regulatory scrutiny intensifies daily, getting onboarding right isn't optional: it's survival.

The Gambling Industry's False Positive Crisis

UK gambling operators face a perfect storm. The Gambling Commission demands rigorous customer verification, source of funds checks, and affordability assessments: all while players expect instant access to place bets on live events. This creates massive friction points where legitimate customers get caught in overzealous screening processes.

The Financial Reality

A single false positive in gambling costs significantly more than other industries. The average online gambling customer generates £1,200-2,500 annually in gross gaming revenue. When legitimate high-value players get rejected, you're not just losing today's deposits: you're losing years of potential revenue.

Consider this: if your onboarding false positive rate sits at 15% (industry average), and you process 10,000 new registrations monthly, you're rejecting 1,500 legitimate customers. At conservative lifetime values, that's £1.8-3.75 million in lost revenue annually.

Regulatory Pressure Points

The UK Gambling Commission's focus on consumer protection creates additional complexity. Operators must verify:

- Age and identity verification within 72 hours

- Source of funds for deposits exceeding £2,000 in 30 days

- Affordability through bank statements and salary verification

- Enhanced due diligence for VIP customers

Each verification layer introduces potential false positive triggers. Players providing legitimate bank statements get flagged because automated systems can't parse income sources correctly. High-earning professionals face delays because their deposit patterns appear "unusual" to risk algorithms calibrated for average earners.

Why Gambling Onboarding Generates More False Positives

Legitimate Player Behavior Looks Suspicious

Gambling customers exhibit financial patterns that trigger traditional fraud detection systems. Large, irregular deposits during sporting events, late-night transaction times, and international payment methods are normal gambling behaviors but appear high-risk to generic screening tools.

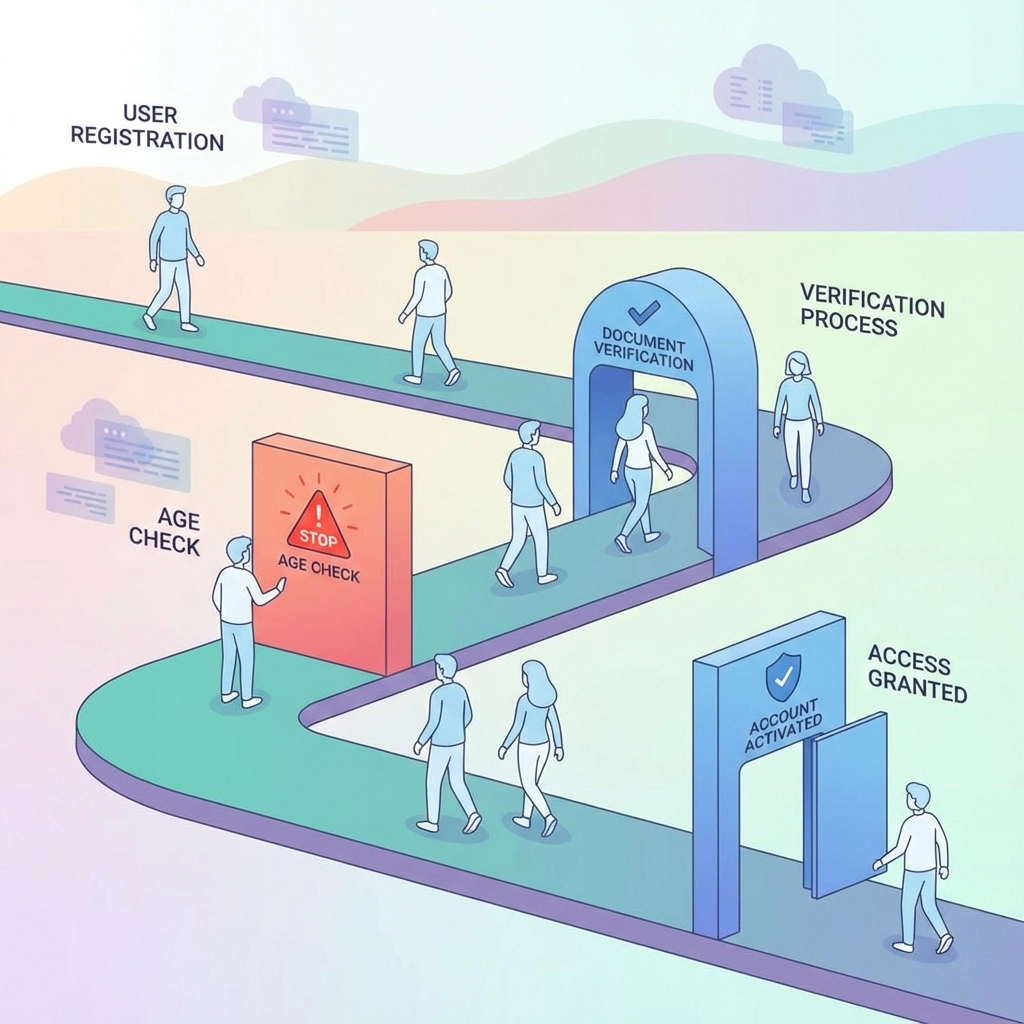

Multiple Verification Touchpoints

Unlike other industries with single identity checks, gambling requires ongoing verification throughout the customer lifecycle. Initial KYC, enhanced due diligence triggers, source of funds requests, and affordability assessments create multiple opportunities for false positive triggers.

Cross-Border Payment Complexity

UK players frequently use international payment providers, cryptocurrency exchanges, or offshore banking. These legitimate payment methods often trigger geographic risk flags in traditional compliance systems not calibrated for gambling payment flows.

Seasonal and Event-Driven Patterns

Major sporting events create massive spikes in legitimate activity that overwhelm basic fraud detection systems. Wimbledon, Premier League finals, or World Cup events generate legitimate deposit volumes that trigger automated alerts designed for normal activity levels.

The Gambling Commission's Expectations

Recent UKGC guidance emphasizes proportionate, risk-based approaches rather than blanket restrictions. The Commission explicitly warns against:

- Applying uniform verification requirements regardless of customer risk

- Creating unnecessary barriers for legitimate customers

- Using verification as a delay tactic for withdrawals

Operators must demonstrate that their verification processes are:

- Proportionate to identified risks

- Based on reliable data sources

- Regularly reviewed and updated

- Customer-friendly while maintaining compliance effectiveness

This regulatory shift demands sophisticated verification strategies that minimize false positives while maintaining robust compliance standards.

Strategic Approaches to Reduce False Positives

Risk-Based Verification Frameworks

Implement tiered verification approaches that match requirements to actual risk levels. Low-risk customers (young professionals with stable employment) require basic checks, while higher deposit customers trigger enhanced verification. This targeted approach reduces unnecessary friction for the majority of players.

Gambling-Specific Data Sources

Standard credit bureau data often fails to capture gambling customers' true financial pictures. Enhanced verification should incorporate:

- Real-time bank transaction analysis

- Payroll verification through secure API connections

- Investment portfolio verification for high-net-worth individuals

- Business income verification for self-employed customers

Advanced Behavioral Analytics

Modern gambling compliance platforms analyze customer behavior patterns rather than just static data points. Players who gradually increase deposits over months present different risk profiles than those making immediate large deposits. These behavioral insights significantly reduce false positives compared to threshold-based systems.

Mobile-First Verification Technology

UK gambling customers increasingly onboard via mobile devices. Modern verification solutions use device intelligence, biometric verification, and real-time mobile network data to verify identity without extensive document uploads. This approach reduces friction while maintaining security standards.

Technology Solution Comparison

Traditional Document-Based Systems

Legacy verification systems require customers to upload passport photos, utility bills, and bank statements for manual review. These systems generate high false positive rates because:

- Document quality varies significantly

- Manual reviewers apply inconsistent standards

- Processing delays frustrate customers during live betting events

AI-Powered Real-Time Verification

Modern solutions combine multiple verification signals instantly:

- Document verification using computer vision

- Facial biometric matching

- Real-time database cross-referencing

- Behavioral risk scoring

These platforms reduce false positives by 40-60% compared to traditional methods while delivering verification decisions in under 60 seconds.

Hybrid Human-AI Approaches

The most effective gambling verification combines automated processing with human expertise for edge cases. AI handles straightforward verifications instantly, while trained compliance professionals review complex cases involving self-employed customers, international income sources, or unusual deposit patterns.

Implementation Best Practices for Gambling Operators

Calibrate Risk Tolerances Specifically for Gambling

Generic compliance tools often misclassify gambling-specific behaviors as high-risk. Configure your systems to recognize legitimate gambling patterns:

- Weekend and evening deposit clustering

- Event-driven deposit spikes

- Legitimate international payment flows

- Professional gambling income sources

Streamline Progressive Verification

Instead of front-loading all verification requirements, implement progressive verification that activates based on customer activity. Initial registration requires basic identity verification, with enhanced checks triggered by specific deposit thresholds or activity patterns.

Optimize for Mobile Customer Experience

UK gambling customers expect seamless mobile experiences. Ensure your verification process:

- Completes entirely on mobile devices

- Uses device cameras for document capture

- Provides real-time status updates

- Offers alternative verification methods for edge cases

Monitor and Adjust Continuously

Gambling customer patterns evolve rapidly. Regular analysis of false positive rates by customer segment, payment method, and verification trigger helps optimize your system performance. Monthly reviews ensure your verification approach remains effective and customer-friendly.

The Competitive Advantage of Getting This Right

Operators that successfully reduce false positives gain substantial competitive advantages. Faster onboarding improves conversion rates during promotional campaigns. Reduced verification friction increases customer satisfaction scores. Most importantly, retaining legitimate high-value customers drives revenue growth that compounds over years.

In an industry where customer acquisition costs continue rising and regulatory compliance intensifies, sophisticated verification strategies that minimize false positives represent essential competitive infrastructure. The operators that master this balance will capture disproportionate market share as regulations tighten and customer expectations increase.

Your verification strategy isn't just compliance overhead: it's a revenue generation system that either maximizes or destroys customer lifetime value at the critical first impression moment.