The legal profession stands at a pivotal moment. Where client onboarding once meant stacks of paperwork, manual verification processes, and weeks of back-and-forth communication, forward-thinking UK law firms are embracing digital transformation that streamlines Know Your Client (KYC) workflows from start to finish.

This shift represents more than operational efficiency: it’s fundamentally changing how law firms build client relationships, maintain compliance confidence, and position themselves for sustainable growth in an increasingly competitive market.

The Digital KYC Revolution Transforms Client Onboarding

Modern law firms are discovering that digital KYC platforms eliminate the friction that traditionally made client onboarding a bottleneck. Instead of requiring clients to visit offices with physical documents or navigate complex postal exchanges, smart firms now enable complete verification through secure digital channels.

Digital intake forms collect comprehensive client information while automated verification tools cross-reference data against authoritative databases in real-time. This transformation means clients can complete their KYC requirements from anywhere, at any time, dramatically reducing the time from initial contact to active engagement.

The impact extends beyond convenience. Firms implementing digital KYC report 75% faster onboarding times and significantly higher client satisfaction scores during the crucial first impression phase.

AI-Powered Verification Delivers Unprecedented Accuracy

Artificial intelligence transforms KYC accuracy by eliminating human error from document verification processes. Advanced AI systems automatically validate identity documents, cross-reference information against sanctions lists, and flag potential compliance concerns before they become regulatory issues.

Machine learning algorithms continuously improve their recognition capabilities, detecting sophisticated document forgeries that manual reviews might miss. This technology creates a verification standard that surpasses traditional manual processes while processing applications in minutes rather than days.

For compliance managers, AI-powered verification provides audit-ready documentation automatically. Every verification step generates detailed logs that demonstrate due diligence procedures, creating comprehensive compliance trails that satisfy regulatory requirements effortlessly.

Integrated Compliance Platforms Streamline Multi-Step Workflows

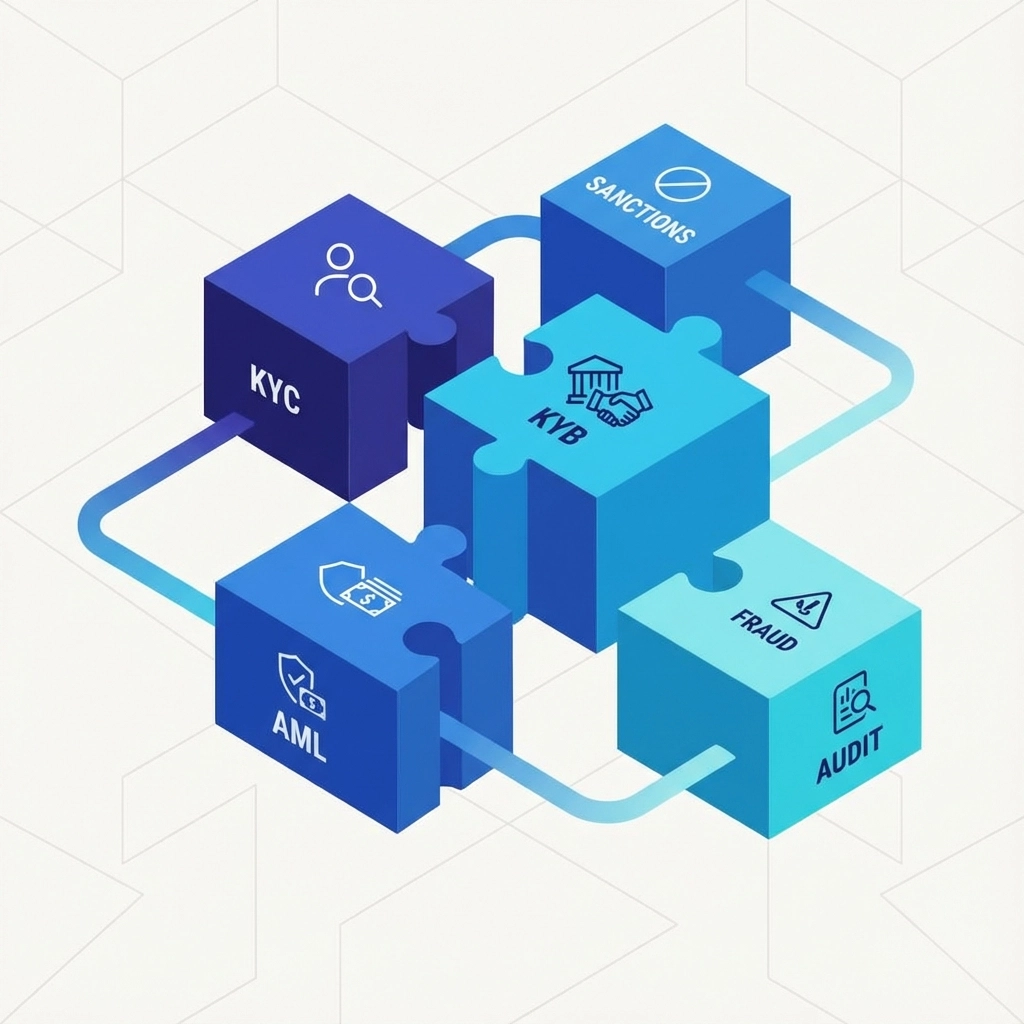

The most transformative KYC platforms integrate Know Your Client processes with Know Your Business (KYB) and Anti-Money Laundering (AML) requirements within unified workflows. This integration eliminates the need to manage separate systems for different compliance requirements, reducing administrative overhead and minimizing data entry errors.

Modern platforms automatically trigger relevant verification protocols based on client type, transaction value, and risk assessment criteria. Corporate clients receive appropriate KYB screening while individual clients undergo streamlined KYC processes, ensuring regulatory compliance without unnecessary friction.

These integrated approaches enable compliance teams to maintain comprehensive oversight across all client relationships through centralized dashboards that provide real-time status updates and regulatory alerts.

Real-Time Monitoring Maintains Ongoing Compliance Confidence

Technology transforms KYC from a one-time onboarding requirement into an ongoing compliance advantage. Automated monitoring systems continuously screen existing clients against updated sanctions lists, PEP databases, and adverse media sources, ensuring compliance status remains current throughout the client relationship.

Real-time alerts notify compliance teams immediately when client circumstances change or new regulatory concerns emerge. This proactive monitoring approach prevents compliance gaps that could develop between periodic manual reviews, maintaining regulatory confidence continuously.

Advanced platforms also track regulatory changes and automatically update screening criteria, ensuring KYC processes remain aligned with evolving requirements without manual intervention.

Client Experience Enhancement Through Seamless Technology

Digital KYC platforms create client experiences that reflect modern expectations for professional services. Clients appreciate secure portals that allow document submission without email attachments, real-time progress tracking that eliminates uncertainty, and mobile-friendly interfaces that accommodate busy schedules.

The technology also enables firms to provide clients with transparent timelines and clear communication about requirements. Automated status updates keep clients informed throughout the verification process, eliminating the need for follow-up calls and reducing administrative burden.

This enhanced experience builds trust from the first interaction, positioning firms as technologically sophisticated and client-focused organizations that understand modern business needs.

Centralized Data Management Transforms Information Access

Technology consolidates client information into secure, centralized platforms that eliminate information silos across different departments and matter types. Authorized team members access complete client verification records instantly, supporting faster decision-making and more responsive client service.

Centralized data management also ensures consistency across all client interactions. Every team member works with the same verified information, eliminating discrepancies that can undermine client confidence and creating unified service delivery standards.

The consolidation extends to matter management, where verified client data automatically populates case files and billing systems, reducing duplicate data entry and minimizing errors throughout the client lifecycle.

Analytics and Insights Drive Continuous Process Improvement

Digital KYC systems generate detailed analytics that enable firms to optimize their onboarding processes continuously. Compliance managers can identify bottlenecks in verification workflows, track completion rates across different client segments, and measure the impact of process improvements on client satisfaction.

These insights reveal patterns that manual processes cannot capture. Firms discover which verification requirements cause client abandonment, identify optimal communication timing, and understand how different client types respond to various onboarding approaches.

Data-driven optimization creates competitive advantages by reducing onboarding friction while maintaining rigorous compliance standards, enabling firms to attract clients who value efficiency without compromising regulatory requirements.

Electronic Signatures Complete the Digital Transformation

Integrated e-signature capabilities eliminate the final paper-based step in client onboarding. Clients can review and execute agreements electronically within the same platform used for KYC verification, creating seamless end-to-end digital workflows.

Electronic signatures provide legally binding execution with enhanced security features including identity verification, tamper evidence, and comprehensive audit trails. These capabilities often exceed the security and traceability of traditional wet signatures while dramatically accelerating agreement execution.

The integration ensures that verified client data automatically populates engagement letters and other agreements, maintaining accuracy while reducing preparation time for fee earners and support staff.

Future-Proofing Through Scalable Compliance Infrastructure

Technology-enabled KYC creates scalable infrastructure that grows with firm expansion without proportional increases in compliance overhead. Automated systems handle increased client volumes without additional staffing, while standardized processes ensure consistent quality regardless of firm size or geographic distribution.

This scalability extends to regulatory adaptation. Modern platforms receive updates that implement new compliance requirements automatically, ensuring ongoing regulatory alignment without system overhauls or extensive retraining.

Forward-thinking firms recognize that early technology adoption creates lasting competitive advantages in client acquisition, operational efficiency, and regulatory confidence.

The Compliability Advantage for Legal Professionals

Compliability delivers purpose-built KYC solutions that understand the unique requirements of UK law firms. Our platform integrates seamlessly with existing practice management systems while providing the specialized compliance tools that legal professionals require.

The transformation from paperwork to platforms represents more than technological upgrade: it positions your firm for sustainable growth in a digital-first business environment. Clients increasingly expect efficient, secure onboarding experiences that demonstrate professional competence from first contact.

Ready to transform your KYC workflows? Discover how Compliability streamlines compliance for UK law firms and positions your practice for future success.